More than anything, the current state of the economy has taught us that having multiple streams of income is not a luxury; but a necessity. It has taught us that ‘job stability’ or the stability that comes with employment isn’t necessarily stable.

It has shown us that whatever we deem to be our normal way of life, lifestyle and routine, can easily be shaken up and nothing is guaranteed.

- 1. Money is a tool, not a toy.

- 2. …But learning about this tool can be fun!

- 3. Encourage them to be passionate.

- 4. Teach them about critical thinking.

- 5. Talk money.

- 6. Teach Them That Money Is A Language

- 7. Teach them that making money is just as fun as spending it.

- 8. Nurturing The Entrepreneurial Mindset

- 9. Children Copy What They See

- 10. Prepare Them For The 'Gig Economy'

- My final words 🙂

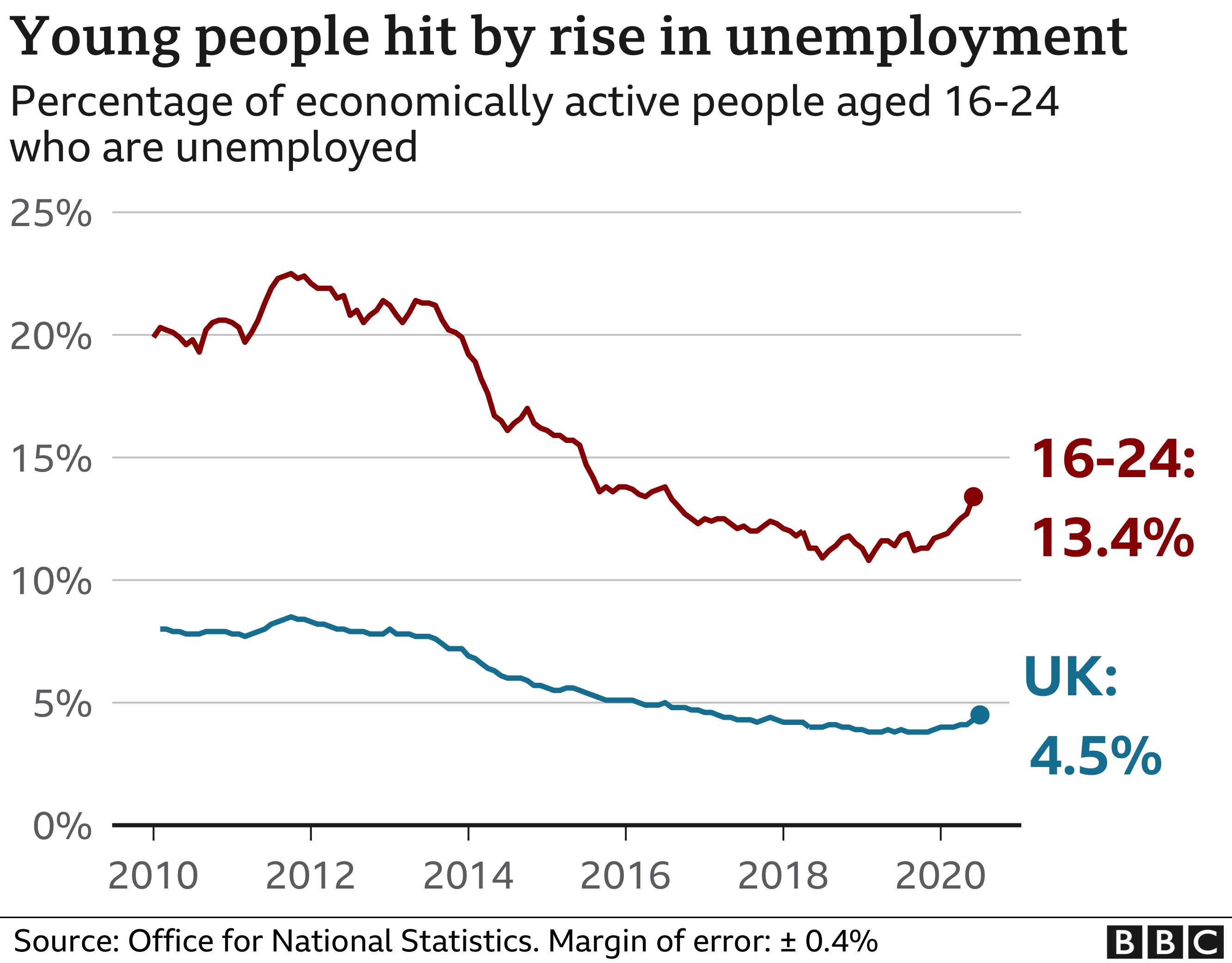

Companies are cutting hundreds of thousands of jobs as Covid-19 continues to hit the economy.

The unemployment rate is rising and the coming end of government support schemes could see it rise even further.

How high could the unemployment rate go? One of the hardest-hit groups has been young people. 156,000 fewer 16- to 24-year-olds are employed, compared to three months ago.

BBC News – Unemployment rate: How many people are out of work?

Black children in this country already had a more challenging path to follow. We have already been telling them they need to be twice or thrice as good to even be equal and obtain opportunities readily available to others.

While I agree that our children need to be great, I definitely don’t agree that they need to do so simply to be noticed by institutions that take this standpoint. They need to be great to build their own institutions and infrastructures that benefit them and continue to create opportunities for others like them trying to strive in a prejudiced system.

Unfortunately, following the current path set out by society does not result in this. Times are changing so fast. 10 years ago who knew teenagers would be becoming multimillionaires on their phones and social media platforms?

In fact, who knew that if given the chance to learn about the stock market, 13-year-olds could build six-figure portfolios?

The onus is on us as parents, to push those boundaries and lift the limitations set on our children by ourselves and society. Parents raising black children need to be aware of how they can unlearn these traditions and improve themselves to raise financially literate children who grow up to be outstanding entrepreneurs.

Here are some of the points to note in the effort to raise entrepreneurial-minded black children;

1. Money is a tool, not a toy.

It is easy for a child to receive birthday money and blow that all on a pair of designer trainers, which, in some cases costs more than a month’s rent for a surviving family.

Yes, it is okay to treat yourself now and then but why not have some rules they can apply for themselves.

Most people do not have control over their impulsive spending and this type of mindset needs to be eliminated and replaced with the concept of delayed gratification.

It would help if you reinforced the value of each pound your children comes in contact with. Managing the little you have makes it easier to manage larger amounts. Each penny counts when you’re trying to build yourself up financially.

The True Cost Of A Pair Of Jordan’s

Black parents have a particular task of defining the value of money and the importance of using it as a tool as well as something they can use to amuse themselves temporarily.

Remember, a sacrifice given only bears fruit if the purpose is defined.

2. …But learning about this tool can be fun!

In my post, Everything You Need To Know About “Gameschooling”, I talk about using games for learning and the role that gaming can play in education. When children are enjoying an activity, they retain so much more information, information that sticks with them for life!

The most advanced yet fun and addictive money game I have ever come across is one by the creators of Rich Dad Poor Dad (if you have not read that book I highly recommend it! You can grab a book or just listen to the Audible version).

Rich Dad CashFlow 101 + 202 Board Game

It is a board game that (somewhat) favours Monopoly. This game took the format of monopoly and turned it into a revolutionary financial education tool.

It teaches concepts and terminology that most adults don’t even know. Hence, when you look at reviews you will see grown people praising the lessons they have learnt, too.

If we can get this information into our children from early, we put them in a position that is the complete opposite of what schools and society prepare them for.

It is way deeper than simply starting a business – it is about creating opportunities, continued learning, trial and error, and building resilience. A resilience that will see them through any economic downturn!

There are so many fun ways to teach them about finances and you can begin from preschool – as long as it is age-appropriate it will never be ‘too much’ for them to handle.

Monopoly Junior

Take these things in stages, starting with Monopoly Junior.

In addition, being that we are in the technology age, you better believe there are all kinds of apps and educational videos on finance for children available completely free!

3. Encourage them to be passionate.

It’s true that passion fuels success. Where there is passion, no height is too high to climb. The secret that cannot be taught in a classroom is being passionate about your goals and focusing on the finish line.

Black parents can help to encourage their children’s passion by supporting and directing it into something developmental.

I often hear of young black boys who are passionate about music and football and reckon they could have gone further with it but say they never received support from their parents’; maybe their parents’ just didn’t approve of their choices or see it as realistic but they pursued it anyway. Perhaps they could have gone further with support?

Rather than not support them once they develop a liking for specific hobbies on their own, you could;

- 1. Guide them by exposing them to a variety of hobbies and things very early.

- 2. Be enthusiastic about the things they show interest in at a young age.

- 3. Introduce them to things that will encourage character growth.

However, sometimes it is less about them only having a passion for certain things but rather them only seeing success in particular areas.

Black children tend to follow certain patterns others have already followed because they can see themselves ‘making it’ like the others did. This happens for two main reasons;

- a) Because of the notion that has been put in their minds about what they can and cannot do.

- b) Because they’ve seen it done before by people like them, around them, from where they come from.

This doesn’t mean that is their only option, we know it isn’t! It just means they weren’t exposed to or encouraged to do a variety of activities growing up and they didn’t see positive examples of people who looked like them doing some of the things they might have dreamed about doing.

4. Teach them about critical thinking.

Critical thinking surmounts using your creative mind to solve problems. In the entrepreneurial world, problems arise all the time; to get through the problem their mind will be required to come up with different solutions and test those out both theoretically and practically. In this instance, somebody who isn’t able to break things down or cannot handle pressure will retreat and give up or pass the issue onto somebody else.

- Additionally, giving them small money problems that you know they can solve and motivate them to come up with a solution is a fun exercise you can act out in the real world.

- Encouraging critical thinking is not only beneficial for your child in the entrepreneurial world but it is a highly beneficial life skill.

- A critical thinker will not run away from problems; instead, they will be challenged to find a fitting solution to the problem.

5. Talk money.

This is especially effective if your child has a basic understanding of how to handle money ie. spend, save, invest, donate.

The next level would be:

– Discussing the value of money

– Concepts for multiplying the little you have

– Sources and different types of revenue

– What money can do for you, your family, your community, others

This knowledge in children and teens grooms a healthy hunger to have and obtain it. Your child will start thinking of ways to rise above the expectation to fail and instead devise ways of making, keeping and multiplying money. Talk about their goals and encourage them to go after them because they are all achievable.

You can bring up such topics, casually when walking to the park or to football, during dinner, when relaxing or tidying up. You can even encourage them by watching films; this would be a good opportunity for you to relate real-life events with the fictional work in movies and let them see that anything is achievable and that their dreams and goals are not too far away. Likewise, real-life videos that inspire the drive to open their minds and dream big can do wonders, we especially love relatable TED Talks. Active watching or just playing them in the background works.

6. Teach Them That Money Is A Language

Teach your child that money is a silent yet clear language that is used every day. When you exchange a good or service for money, you’re defining just how important it is to you without saying the words. Children should not be afraid of associating money with language. Build in them the respect for money, and associate it with their daily lives, reiterating the importance of understanding the balance.

How To Teach Black Children Financial Literacy

7. Teach them that making money is just as fun as spending it.

Associate the process of making money with spending money.

When you complete a task and are due for payment, there’s no greater feeling than when you receive the money, so why shouldn’t you enjoy the process of completing that task as you get ready for payment?

Teach your child that making money can be strenuous, but it doesn’t have to be boring and dreadful. Nobody wants for their child to grow up and absolutely despise what they do for money, just to get by.

There are opportunities to make enjoyable and fun money, just as fun as spending the money itself.

8. Nurturing The Entrepreneurial Mindset

Individuals with an entrepreneurial mindset see opportunities and gaps in the market where others see obstacles or boundaries.

It is important to focus on the development of your child’s mindset rather than simply getting them to start a business or do something for money. Understanding the process and the action in its entirety will help them develop the transferable skills to do it again and again.

Anybody can inherit a family business, run it and thus become a business owner but what if they do not have the skills to replicate that business model they inherited? What if they cannot grow that business themselves, create more franchises or worse, run it into the ground or undervalue it and simply sell it.

You always hear stories of people inheriting family homes, businesses and land but then selling it off straight away. They are only able to see cash value and not asset wealth value.

9. Children Copy What They See

Walking the talk is essential if you want your child to emulate those behaviours. In the same way that they will pick up our bad habits they will pick up our good ones; money is no different in this respect.

If you’re encouraging them to be entrepreneurial in a world that has already set them up to fail or be mediocre, you need to show them that it’s not written in stone that they must fail.

1. Start a small business and include them in it.

This doesn’t have to be anything major. You can take the opportunity to pick their brains on things like logo design, simple marketing strategies, packaging (if it is a physical project), the hiring process if outsourcing etc.

At every age, they can help and feel integral with decision making.

Bring their ideas to life and let them watch, then make them a part of it. The thrill of seeing an idea come to life and bear fruit; however, small will push them to develop bigger and better ideas and work harder to bring them to life.

2. Tell them when you are paying a bill, show them how much you are paying and how you are paying it. Whether that is setting up and explaining what a direct debit is, paying by card over the phone or internet or going to the post office with a postal order (if they still do that…)

3. Show them how you save or invest your own money.

You can choose to be as transparent as you like or not at all. You do not need to disclose what you earn but you can show them the different methods of how you save. Make a lesson out of it. Tell them you are putting away a certain amount or percentage into your savings account, pardner or anything of the sort.

Or maybe your AER is way to low and you have been considering shopping around for a new savings account – these are all processes you can show them and explain to them. Lots of learning opportunities in day to day living!

10. Prepare Them For The ‘Gig Economy’

This one will not be on many ‘teach your child financial literacy’ type posts. Simply becasue most information is regurgitated and out of date. Preparing them for the ‘gig economy’ simply means, the world has changed and is changing fast. The gig economy is something we have never seen before. Whilst there have always been hustles and side jobs there has never been an entrie emerging economy whereby just using the internet people can exchange digital favours and skills for money.

The hustle has gone digital!

Not to mention, many companies are now employing freelancers for short-term, long-term and one off jobs where they would have usually gone through the process of hiring people. Many businesses now operate solely online – this means there are a decreasing number of physical workplace jobs available.

Outsourcing freelancers is the new job search.

This isn’t to say that physical labour will never be required – I cannot see a world where the only trucks on the road are AI-powered self-driving trucks (I could be wrong….check back in 10 years). But there is a shift taking place – just as advertisers have shifted a huge percentage of their advertising budget from TV to Youtube over the years, everything is changing. This is the gig economy.

Teaching children that they can monetise their skills and talents is a good place to start. Children used to get paper-round jobs to earn money, or help a friend of the family out at the market on the weekend like I did.

These kind of things are what successful entrepreneurs speak about and look back on.

As these types of things become less common there is no reason to throw them out altogether – just adapt.

My final words 🙂

I just wanted to conclude by stating that the most important thing when raising entrepreneurial-minded children is always keeping the journey fun.

Nurture a love for creativity and dreaming big, a love for adventure, and understanding that the possibilities are endless.

Show them the beauty and freedom in being a problem solver and the hard work required to persevere, reminding them that there is always a light at the end of the tunnel.

Take every opportunity to teach them these critical life skills.

Always be their biggest supporter and show excitement and interest in the things they do.

Strive to find solutions together, as they develop, they will naturally cultivate their own framework for risk assessment and become confident decision-makers.

Continue to allow them opportunities to assert their independence through responsibilities.

And always reward practice, perseverance, and delayed gratification.